Content

When the there are shared people who own the fresh withholdable fee, see Repayments directly to helpful owners lower than Repayments in order to Users inside the the brand new Guidelines to have Form 1042-S. To invest the fresh winnings as opposed to withholding U.S. taxation, the newest casino need make an application for and possess an ITIN for Mary since the an expedited ITIN can be acquired on the Internal revenue service during the time of the fee. An endorsement agent try a person who, less than an authored agreement to the Irs, is registered to aid alien someone or other international persons get ITINs otherwise EINs. To possess information regarding the application form steps to have to be an affirmation broker, check out Internal revenue service.gov/Individuals/New-ITIN-Acceptance-Agent-Program-Transform. A price paid back so you can a foreign payee on the supply of a guarantee out of indebtedness provided once Sep 27, 2010, can be subject to chapter 3 withholding.

FinCEN Finalizes Domestic A property Revealing Criteria

Truth be told there go the newest keyboard lessons, the fresh food, the brand new vacations, the school outfits an such like. We all get to purchase our cash on whatever you really worth, but you can trade a little nicer house to own a lot away from most other enjoyable blogs. The very last choice is the one they’re going to probably capture- enter far more personal debt to pay for the existence for 2 years and you will guarantee they are able to alter their habits one to first going to 12 months.

How to avoid financing progress tax for the property product sales

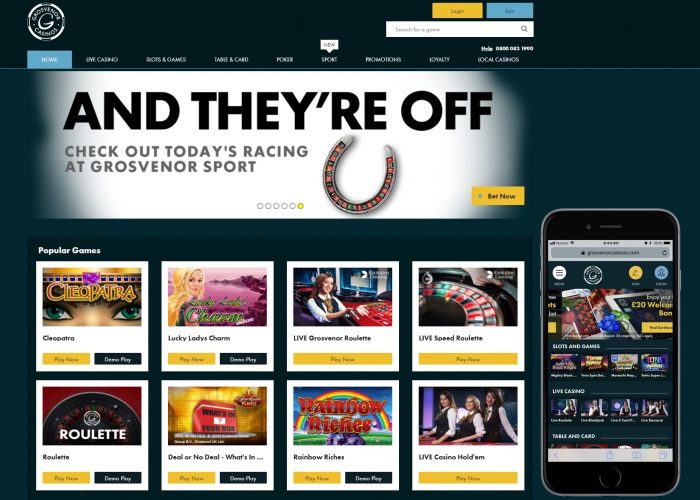

A property using systems try just in case you want to join other people inside committing to a relatively higher commercial otherwise domestic bargain. The newest financing is established through online a house platforms, which can be labeled as home casino Pocket Fruity review crowdfunding. A business need to pay away 90% of its taxable payouts in the form of returns to keep up their REIT status. That way, REITs avoid investing business tax, while other programs is actually taxed for the winnings to see if or not and how to spreading once-income tax profits because the dividends.

Particularly as the spending PMI hasn’t been tax deductible since the 2021, it will no-good for you. A health care professional or “doctor” financial are another mortgage system a loan provider leaves in place to draw high-income members by allowing health professionals including doctors and you can dental practitioners to safer a mortgage that have less limitations than a traditional financial. Fulton Mortgage lender also provides zero off to $step 1,five-hundred,000, 5% off to own fund away from $step one,500,001 to $2,100,100, 10% off Finance out of $2,100000,001 so you can $step three,100000,100000.

Why you should purchase a property?

Really property management organizations tend to fees ranging from 8-10% of your own monthly leasing money, nevertheless they’lso are a blessing for buyers that too busy to cope with landlord responsibilities or monitor the newest clients. When you rent a house in order to clients, you’ll become the de-facto property owner of the house. You’ll features multiple property manager loans in order to meet, in addition to choosing builders to complete maintenance jobs if needed (you’re the person who’s have got to get the new local plumber).

Thus, including, a collaboration might not reduce the count that it’s necessary so you can withhold within the tips discussed within the Legislation point step one.1446(f)-2(c)(4) (changing the amount at the mercy of withholding according to a transferor’s restrict tax accountability). Such, when the a partnership is required to withhold $29 less than point 1441 for the a great $100 delivery, the maximum amount required to become withheld thereon delivery below area 1446(f)(4) is actually $70. The relationship will get have confidence in so it degree to choose the withholding obligations it doesn’t matter if it is offered inside go out prescribed in the Regulations area step one.1446(f)-2(d)(2). While the relationship get a certification on the transferee, the relationship must withhold 10% of your amount know to the import, quicker by the one amount already withheld by transferee, in addition to one computed attention. The time to possess submitting Forms 8288 and you will 8288-A toward statement point 1446(f)(1) withholding is equivalent to to have point 1445 withholding. A comparable regulations to possess filing Forms 8288 and you can 8288-A from the transferees withholding income tax less than area 1445 apply at transferees withholding taxation under section 1446(f)(1).

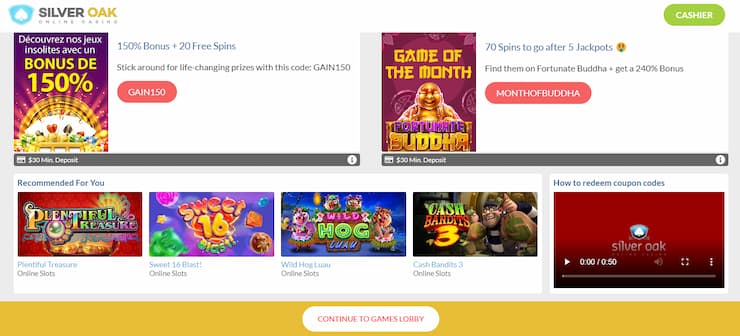

To make payments due to custom-branded web sites, mobile pages

If you decide to purchase a specified lowest-money people, you’ll rating one step up inside tax foundation (their new rates) following the very first 5 years, and you may people progress immediately after ten years would be income tax-free. The amount a purchaser has a tendency to buy a real home investment (i.e., property). A good levy enforced from the Internal revenue service to your profits produced from the brand new product sales out of a secured asset, including brings or home — one to profit is recognized as nonexempt income. The good news is, it is possible to stop or reduce the funding progress taxation for the a house product sales to save as much money on your wallet that you can.