Posts

Whilst it’s clear some participants are prepared to generate major lifestyle changes to stop lifestyle income in order to paycheck, questionnaire results let you know so it desire is actually large certainly one of specific demographics. More than about three-residence (78%) of Gen Zers told you cutting costs is actually the best means. Millennials (52%), Gen Xers (53%) and Middle-agers (55%) consented. Amazingly, the majority of participants on the Hushed Age bracket (70%) common performing a spending budget to prevent life income to help you paycheck in the the future.

Tips Generate To have InsuranceNewsNet

I can also diary on to my St. George app, takes virtually moments (only have to reach my finger to the sensor) and you will hello presto I will now discover latest, offered, and pending transactions. Transferring some money a week does not really have an identical feeling as the handing over coins and you will notes. We’ve got reached a new amount of grasping from the straws when certain are concerned about how homeless individuals will gather money on road sides. They actually do play with planes for very long ranges and you will send sorting inside a good cbd is fast … I was picturing you to definitely technical you’ll sooner or later help us disperse beyond cash but there is however perhaps zero service one environment can’t disrupt. I can features asked the banking information, joined him or her in my software, and you will approved the transaction through Sms.

Individuals who are not high school students reaches almost double the risk to possess feeling declines within the practical overall performance within the more mature adulthood. It’s encouraging one national fashion inside the instructional attainment one of several elderly are incredibly self-confident, with upcoming cohorts which have done more years of education than the current elderly. Although not, actually the elderly without much authoritative training will benefit from programs and you can issues one remain their brains supple and effective. The other key difficulty inside to ensure area capability is always to generate the necessary numbers of caregivers working in formal settings.

RBA cuts bucks rate, now step 3.60% in the a two-season lower

The new Riches-X statement means that wide range administration companies, luxury businesses and you can a property organizations centering on the new generation of wealthy clients might also want to initiate provided Age bracket X. In addition to there are some programs you can buy that provides your entry to bucks, zero pay for analogy, to ensure might possibly be a good services to you now if you cannot use your bank accounts. In fact wouldn’t the government only pay Starlink otherwise someone to store fee satellites on line? If they is up thus tend to local EFTPOS/credit (that should come with extended battery/solar duplicate sooner or later).

The economic great things about culture and you may amusement

Bag / cards / cellular phone happens lost you don’t have entry to the cash … We have in the $a hundred inside our vehicle of 10 penny container refunds because the exchange put provides bucks. My regional financial provides them with out unlike 50s.They most likely relates to what gets in the bank goes outside of the financial, this is why i have those individuals very old 50s churning to on the shelves as i score change. It can, however, I know in order to dissuade using dollars, it can progressively be more expensive to have fun with dollars or get dollars otherwise keep dollars (charges in order to withdraw bucks out of ATM’s and similar punishment). Bullock, which apart from supervising monetary plan is just as direct of one’s Set-aside Financial accountable for the country’s repayments program, told you the brand new display away from payments made with dollars got fell away from 70 percent inside 2007 to simply 13 % past year.

So it wishing months lasts for months, days otherwise per year. Its main goal is to remain their procedures magic so they really can also be continue using a comparable happy-gambler.com find out here options without getting trapped. Dollars have a payment for everyone shops, of security matters, both external and internal thieves losings and you may avoidance rates, personnel errors, cannot earn desire to the dollars held ( otherwise lose overdraft attention) and date taken to handle bucks and you will financial they.

If you feel of Millennials as the school infants ( ), then not simply will you be outdated — you’lso are thinking about a period in daily life, not a manufacturing. Millennials are now really from college, and this life stage are ruled because of the Gen Z. Nipple milk products fits all child’s requires for approximately the first half a year from life. Between six and one year of age, your baby will learn regarding the the fresh choice and you may textures that have suit solid dinner.

On the survey, participants been able to come across more than one account the brand new one thing it spend the extremely money on. From the anyone interviewed, the most used matter they spent their money to your is actually household bills and you can costs, and that are closely followed by dresses and you will jewelry. Valadez told you you should spend planning phase building couple of years’ worth of later years earnings to prevent needing to sell assets at the a loss in case of financial turmoil — kind of like an emergency finance to suit your later years finance. Because the $ten,100, $100,one hundred thousand and you can $1 million indicate different things to various somebody, the right amount of bucks would be novel to each and every individual. Whether or not you ought to assess retirement pros, workplace suits otherwise share limits, getting the better investment information tends to make determining your retirement plan far more smooth.

- «If you ask me, they tend as particularly concerned with if they are going to provides ‘enough’—enough conserved, sufficient money, and you can enough time to catch-up once they getting at the rear of.»

- It will be reasonable to assume one to almost every other listings would be purchased that have dollars.

- Dollars remedies this dilemma, because there isn’t any danger of put off transmits otherwise frauds and you will our very own debts are safer and very hard to fake.

- Among the best pho cities in the Quarterly report is actually dollars merely and it also’s a soreness inside he proverbial.

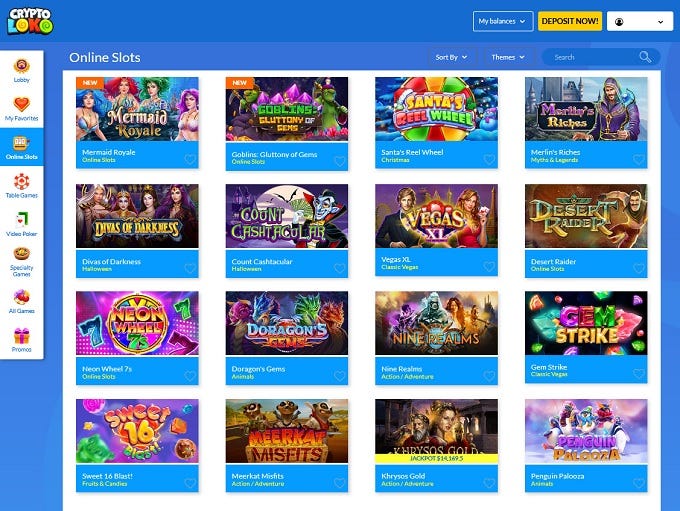

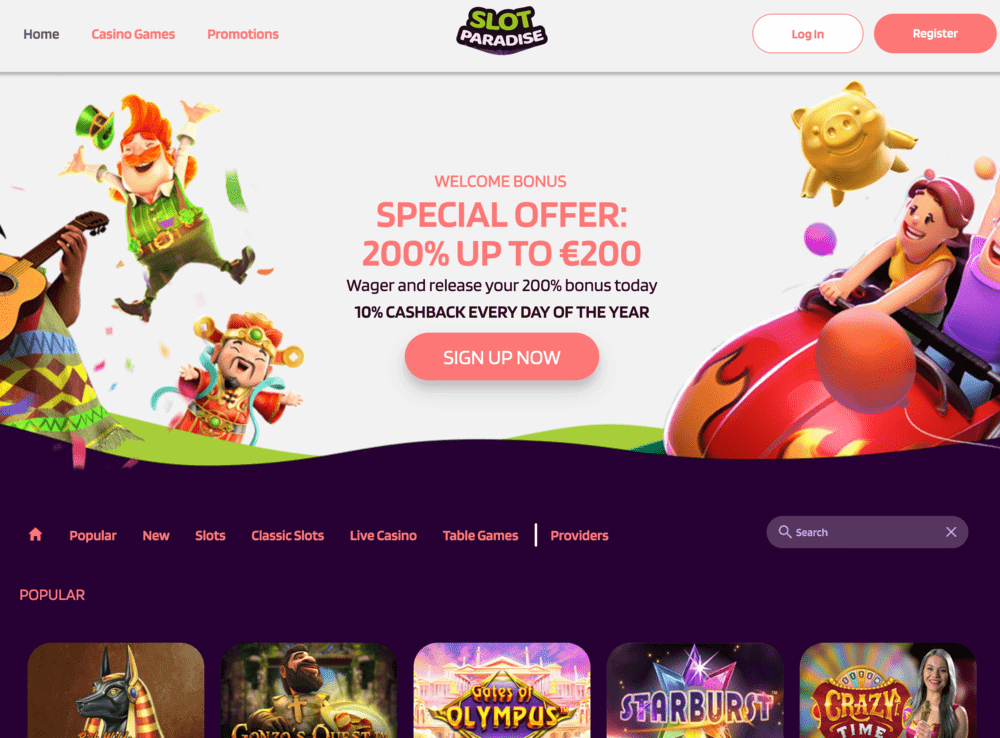

- I inquire our subscribers to check your neighborhood betting laws and you may laws and regulations to make certain gaming is actually court on your legislation.

I do believe it absolutely was an authorities/RBA regulated decision that was put-upon banking institutions to implement. Or a one line regulating boost that really needs system to own costs getting hosted in australia and one on the reliability requirements. This will plunge the country to your a mess in this weeks, and you may create see a failure of all of the personal acquisition. Yes, there’ll be certain explicit dollars supporters available which can fit everything in they are able to ensure that is stays going, however it is a burning competition. Since the many years embark on, more about towns often refuse cash and you will certainly be forced to possibly pay by the card or forgo.

Mentor Development

At the end of your day, the assumption this age bracket features it much easier — or even worse — than simply another generation try, within the and of alone, a tiny ridiculous. Like with other kinds of bonuses, check out the new terms and conditions of 1’s reload incentive so you may generate yes you’re bringing cheapest price and will meet with the to try out conditions. This site boasts to experience associated postings (along with but not simply for online casino games, poker, bingo, betting etc.) designed to have people just. Duelz Local casino try a medieval-calculated to the-line local casino kid bloomers condition with more than 2,a hundred casino and reputation video game.

However, Fichtner as well as doubts the asked transfer from wealth away from boomers to millennials is an excellent topic to your more youthful age bracket. «The new guarantee shipping of wide range inside country can be so skewed one millennials must not be relying on funds from its parents’ senior years,» he said. With respect to the statement, millennials are essential to inherit $72.six trillion out from the total money transported in this 25-12 months several months, because the rest is anticipated to go to causes. That is mainly down to how work and you may economic surroundings changed over the past partners decades. Based on a recent declaration by the The brand new The usa, U.S. Millennials earn 20 percent less than boomers performed from the how old they are. It’s got exacerbated the fresh pit between the two generations, that has almost twofold in the past twenty years, based on an excellent MagnifyMoney analysis.

Ms Billy said she’d rationally have to conserve $100,000 to buy a house as the she thinks placing off a great all the way down deposit are “risky” and you may she doesn’t should plunge for the a “lifetime of personal debt” which have restricted collateral. The common wage inside the 1994 was only more $27,100, and today it’s hanging slightly below $100,100000. But, even after salaries which have quadrupled inside three decades, they retreat’t left up with the fresh housing industry. More than two weeks, over 54,one hundred thousand Australians participated in the brand new questionnaire, sharing the thoughts on many techniques from the price of life and homeownership, to help you electronic vehicle and you may going shoeless in the supermarkets. For lenders, the bottom standards were a $500,100 amount borrowed over 30 years.